Why is this topic relevant to me as a software entrepreneur?

Due to the critical importance of acquiring and retaining new customers, software companies often have to accept temporarily lower profitability and margins in order to achieve high growth rates.

It is not uncommon for young, rapidly growing companies to become unprofitable or even loss-making due to high marketing and sales costs for customer acquisition. On the other hand, it may happen that a company already holds significant market share and therefore grows only slightly, while being highly profitable due to economies of scale from its already large customer base.

- How do corporate buyers assess this conflict?

- Do buyers place greater emphasis on one of the two aspects than the other?

- Is my company better positioned for a sale in one of the two phases?

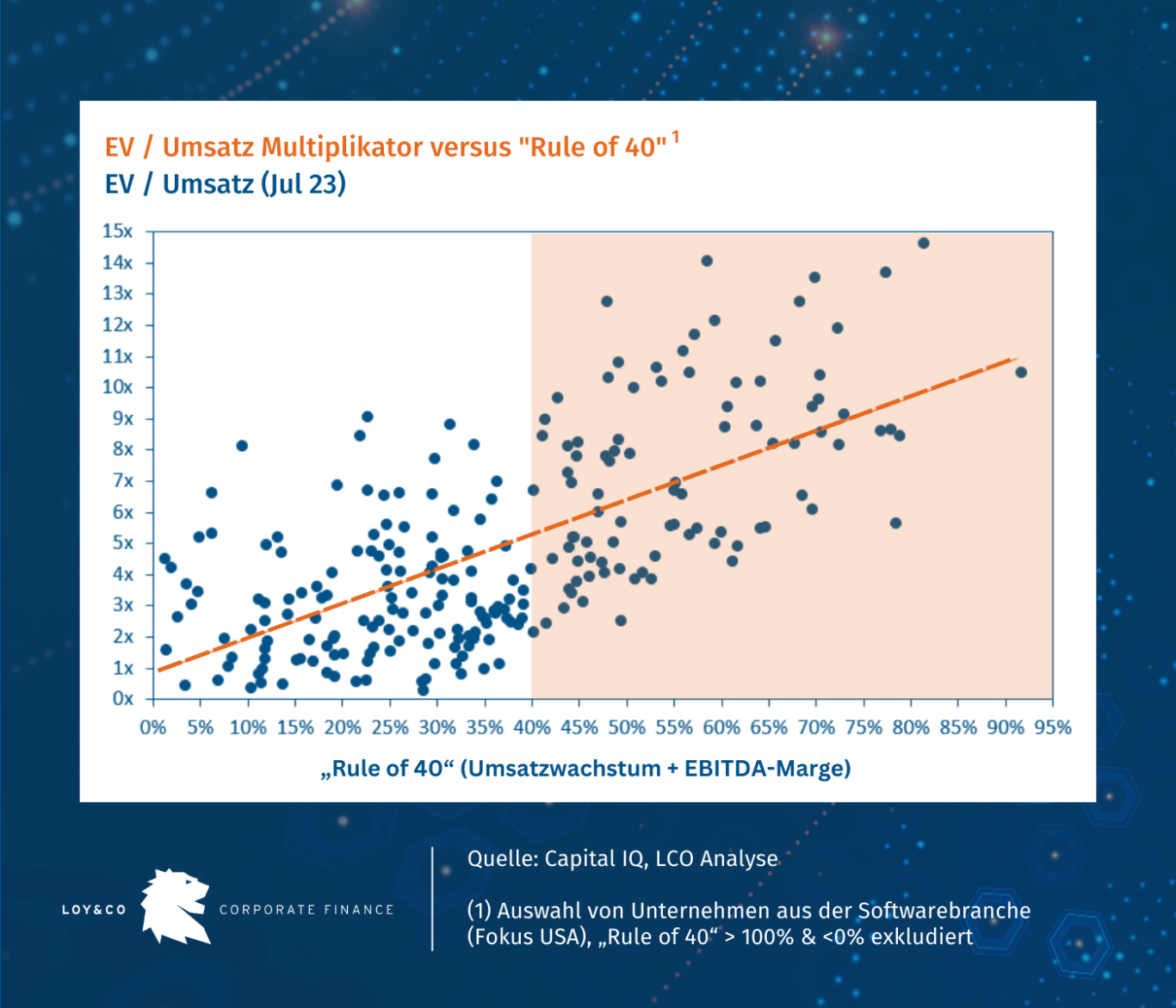

To answer these questions, in this article we examine the so-called “Rule of 40,” which has established itself primarily in the software industry as a key financial metric to ensure comparability between companies.