What do I need to know about this?

In contrast to the “Rule of 40,” these two metrics are often calculated and analyzed from a so-called “unit economics” perspective, i.e., value and cost per individual customer.

Customer Lifetime Value (CLV) quantifies the estimated total revenue generated by a customer during their entire business relationship as a customer of the company. The calculation of this metric is therefore a formula based on (i) the length of the customer relationship (e.g., in years) and (ii) the average revenue over a specified period (e.g., per year).

Customer Acquisition Cost (CAC), on the other hand, quantifies the cost per new customer and can be roughly calculated using the formula of marketing and acquisition expenditures per new customer acquired over a specific period. The lower the Customer Acquisition Cost (CAC), the faster the company reaches break-even at the individual customer level.

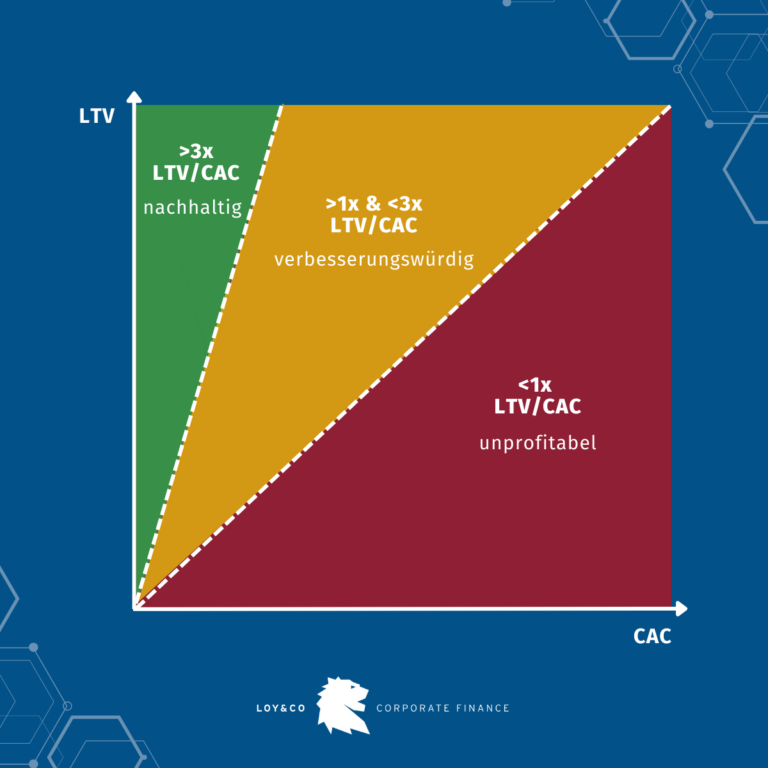

Like growth and profitability in the “Rule of 40,” corporate buyers typically consider the two metrics intertwined and draw various conclusions from the financial metrics:

How can I use this information to my advantage?

To achieve the highest possible ratio between Customer Lifetime Value (CLV) and Customer Acquisition Cost (CAC), and thus high ratings in a sales process, various levers can be used.

The Customer Lifetime Value (CLV) can be maximized by extending the customer relationship or increasing the average revenue per customer:

- Length of the customer relationship: Software companies regularly extend their customer relationships through:

- Discounts for choosing long-term contract models

- Discounts for contract extensions

- Integration with the customer’s remaining system landscape to make switching providers unattractive

To increase the average revenue per customer, software companies typically offer multiple versions of their software in different versions and price categories. Selling additional user licenses or more complex software leads to an improvement in average revenue with that customer (so-called “upselling”).

To manage and accurately calculate the Customer Acquisition Cost (CAC), a salesperson should have a clear overview of the total costs and new customers acquired per sales channel. These marketing measures include, for example:

- Internal/external sales teams

- SEO / SEA

- Online marketing ads

- Print media, TV, and radio

Software entrepreneurs can thus focus sales approaches on particularly efficient and cost-effective channels when initiating a sales process or implement appropriate methods and strategies to plausibly substantiate planned reductions in the Customer Acquisition Cost (CAC) in their business planning to a potential buyer.