In our consulting practice, we repeatedly encounter situations in which partners wish to separate from each other without having agreed on appropriate legal rules.

The reasons for this are varied; here are a few examples:

- Company founders who, after many years together, have developed different interests, for example, one partner who wants to retire while the other remains active.

- Family constellations in which cousins or siblings no longer get along.

- Joint ventures are also often faced with the challenge of a fair separation.

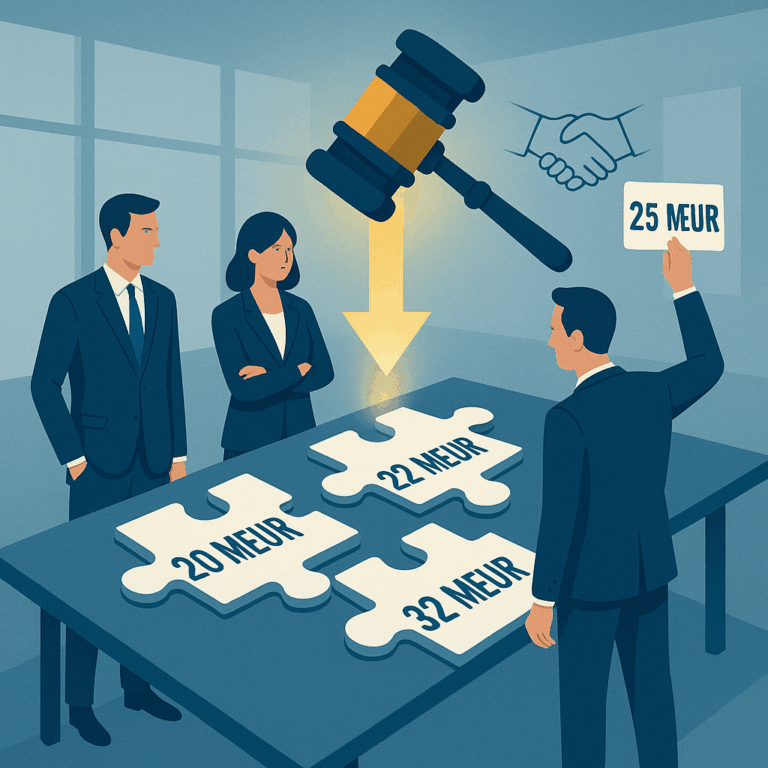

In practice, we frequently see partners seeking a separation without having clear contractual arrangements in place for this case. To resolve such situations in an orderly manner, five approaches have proven effective, which may be useful depending on the situation.