In the current market environment, the purchase price expectations of buyers and sellers are drifting noticeably apart. Many companies are faced with declining sales, planning uncertainty, and weak earnings. While sellers often view these developments as temporary, buyers are calculating more cautiously and considering potential risks in their valuations. This leads to transaction negotiations stalling or failing altogether. However, especially in cases of age-related or urgent succession planning, there is often no room to wait for better conditions.

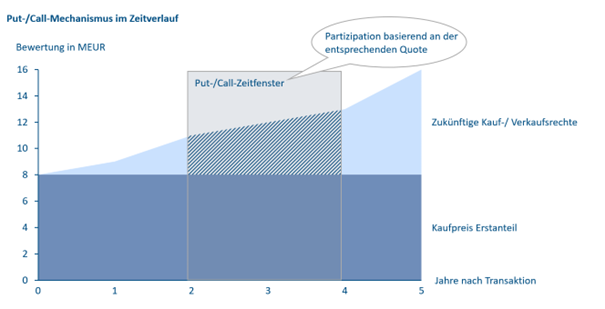

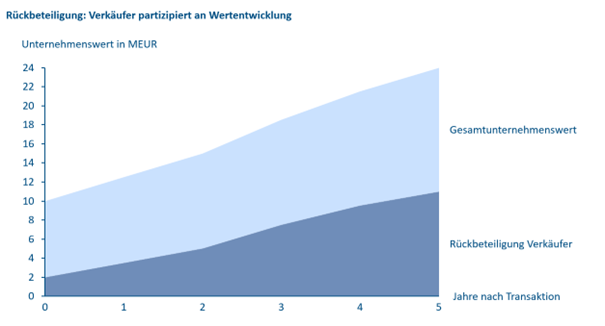

To reach an agreement in such situations, flexible instruments that integrate both perspectives are needed. In practice, three structural elements have proven particularly effective: earn-outs, structured purchase price options, and reinvestments. They offer the opportunity to constructively bridge valuation differences, distribute risks fairly, and jointly shape economic success. They create the necessary bridge between current risks and future opportunities.

Earn-Outs: Purchase Price with Performance Component

Earn-out clauses link a portion of the purchase price to the company’s future development. This variable portion is typically around 15 percent of the total purchase price and is only paid out if previously defined targets, such as sales or EBITDA, are achieved within a specified period. This period typically lies between one and three years after closing.

It is important that the agreed key performance indicators are objectively measurable and as resistant to manipulation as possible. Payments are often staggered. A pro rata amount is due upon target achievement of approximately 85 percent, and the entire variable tranche is due upon full target achievement. For the model to work, the active involvement of the seller in the operational business during the earn-out period is crucial. Without clear responsibilities and transparency, conflicts of interest or disputes over the calculation basis are likely.

Practical example:

A medium-sized company in the automation technology sector is to be sold as part of a succession plan. Due to a currently weak order situation, the parties’ purchase price expectations diverge significantly. The solution: an earn-out model that reflects the expected economic recovery.

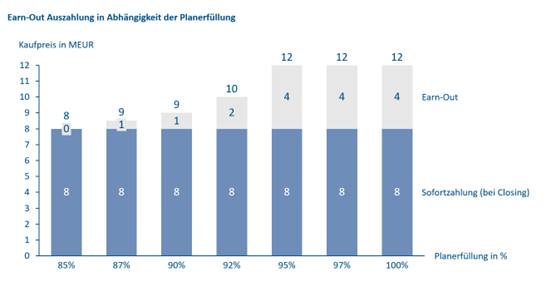

The buyer initially pays a fixed base purchase price of eight million euros. A further up to four million euros is committed as an earn-out. The payout is tied to achieving an EBITDA margin of 15 percent with revenue of 16 million euros in the first full fiscal year after closing.

If this target is fully met or exceeded, the seller receives the full variable tranche. If the target is between 85 and 95 percent achieved, the amount is paid out pro rata on a straight-line basis. If the target is underachieved by more than 15 percent, the earn-out is completely waived.

The chosen structure creates a fair balance of interests. The buyer reduces its risk in an uncertain market environment, while the seller retains the opportunity to realize the full value of the company – provided its expectations are confirmed.