Company valuation – what is a realistic purchase price?

What factors influence the value of a company?

Whenever it comes to the succession, purchase or sale of a business/company, the topic of valuation is central. The first rather rough calculations of the company value are usually made at the very beginning of the considerations for the sale of the business/company and are usually continued and increasingly refined until the conclusion of negotiations. Since every company is different and a multitude of factors can influence the valuation of a company, valuation is often perceived as complex.

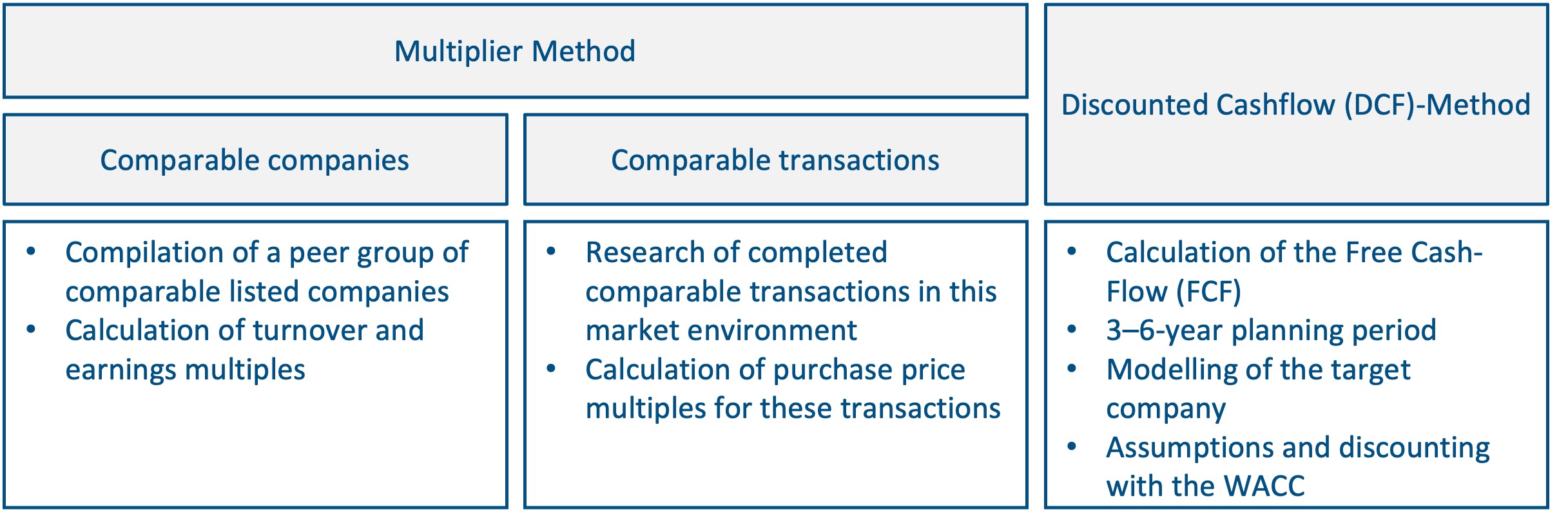

In practice, valuation methods span from quite easy-to-use multiplier methods to very sophisticated methods based on risk-adequate discounting of future cash flows. Common to all methods used in M&A practice today is that they first determine a debt-free enterprise value (“cash and debt free”), from which the net financial debt on the valuation date must then be deducted in order to calculate the value of the equity (which corresponds to the purchase price).

Many factors can influence the valuation of a company; we would like to mention the five most important valuation factors

- Growth

Is your company growing little or fast? Little is 2% to 3% per year, fast growth regularly more than 10%

- Margin

Is the sustainable EBIT margin rather modest at 2-3% or is it higher than 10% (for industrial companies)?

- Size

The larger the company, the higher the relative valuation, because larger companies are seen as less risky. In absolute terms, around 80 MEUR to 100 MEUR turnover are relevant thresholds.

- Capital intensity

How much capital is tied up in investments and working capital (inventories, trade receivables less trade payables)?

- Market and Competition/Unique Selling Propositions

How competitive is the market in which you operate? Is the market being served growing? Or is company growth only possible through crowding out? Does the company have clearly identifiable, plausible and defensible competitive advantages?

These methods are used to calculate the value of the company

Multiplier methods

Multiplier methods are simple and quick methods for valuing a company, and for this reason they are often used in practice. The multiples are derived more or less systematically from a group of comparable companies. These can be comparable listed companies or transactions with company shares of comparable (non-listed) companies.

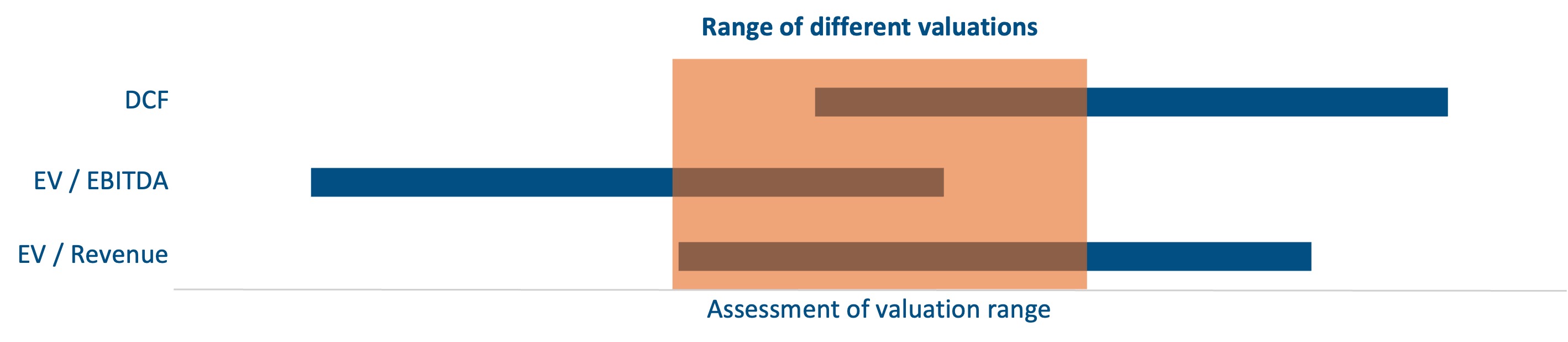

In practice, three multiples are used:

- Turnover multiplier – When companies are growing strongly and / or no positive earnings figures are available.

- EBITDA multiplier – for companies with cyclical investment behaviour

- EBIT multiplier – For companies where investments are regular or play a subordinate role.

In most cases, EBIT is used as the basis for valuing established companies, as EBIT is closest to cash flow when capital expenditure is roughly equivalent to depreciation.

Of course, it must always be kept in mind that the EBIT of a given year often does not represent the “true” company result. Therefore, the EBIT is normalised, i.e. extraordinary income and expenses or special influences by the shareholders (for example salaries, vehicles, rent) are removed from the profit and loss account.

Furthermore, the reference year has a great influence on the value. As a rule, the current business year is used (current forecast). If only one year is used, growth potential or cyclical trends may not be adequately taken into account. Adjustments may therefore be necessary to arrive at an appropriate basis.

If the potentials are sufficiently concrete, they can be adjusted. Under certain circumstances, averages of several years can be used, which take into account both the planning period and the past. In the current COVID19 crisis, companies can be valued appropriately in this way.

Comparable Transaction Analysis

The first method is based on comparable transactions. To form the comparison group, transactions involving companies from the same industry are considered. This method is based on the idea that multiples paid in the past for transactions that have already been completed also reflect the “fair market price today”.

The approach of valuing via transactions of comparable companies has great strengths when it comes to valuing companies that are not listed and are usually much smaller, more focused and more regionally positioned than their usually much larger, more diversified and more international listed competitors.

Unfortunately, however, the valuation procedure also presents difficulties in practice:

- The available information is often insufficient, as the details of transactions by private companies are often not published or not published in full.

- The time period from which the transactions originate must be long enough to obtain a representative set of data. Since the valuation of industries changes over time (e.g. because interest rates, technologies, growth prospects change), values determined in this way can deviate from the current value.

Comparable listed companies

The second method is based on the valuation of comparable listed companies (also called trading multiples or trading comparables). The idea behind this method is similar to the valuation using transactions of comparable companies.

The advisor creates a peer group of listed companies that correspond as closely as possible to the company being valued. In this method, the multiple is determined as a multiple of the stock market value of the financial ratio (EBITDA or EBIT) of the listed comparable companies.

This method has the advantage that the data for listed companies are up-to-date, fully publicly available and relatively easy to collect

The disadvantage is the often severely limited comparability of listed companies with a German unlisted SME. Imagine comparing Coca-Cola with a medium-sized, regional beverage producer in Germany. Aren’t the dissimilarities greater than the similarities? Compared to listed companies, medium-sized companies are often more regional, smaller and specialised. Moreover, shares in listed companies are highly fungible, i.e. they can be sold in variable quantities at any time without time expenditure and minimal transaction costs.

Discounted cash flow (DCF) method

To calculate the value of a company using the discounted cash flow (DCF) method, the company’s future cash flows are forecast and discounted at risk-adequate discount rate. In the DCF method, the enterprise value is essentially determined by the cash flow assumed to be sustainable at the end of the detailed forecast period (“perpetuity”). The cash value of this perpetual annuity can amount to 60-70% of the enterprise value. In contrast to the discounted cash flow method, the capitalised earnings method is not based on payment surpluses, but on earnings or annual surpluses. In a normal M&A process, the capitalised earnings value hardly plays a role. In the discounted cash flow (DCF) methods, the gross approaches dominate in the M&A environment, in which the cash flows to equity and debt providers (so-called free cash flows) are discounted with the weighted cost of capital (weighted cost of debt and equity or WACC). From the enterprise value determined in this way, the purchase price accruing to the equity providers is then calculated by deducting the net financial debt.

The strength of the method lies in its accuracy, as it fully maps the future development of a company, including future investments and the development of working capital. Therefore, this method is also the one favoured in valuation theory.

In practice, however, this method often encounters difficulties. On the one hand, the cost of capital is derived from comparable companies listed on the stock exchange. For the reasons already mentioned above, such as size, diversification, fungibility, etc., these can only be transferred to SMEs to a very limited extent. On the other hand, the planning period of 3-5 years is associated with planning effort and corresponding uncertainty.

Net asset value method and non-operating assets

The valuation methods mentioned so far assume that all assets transferred with the business are necessary to achieve the planned EBIT results. This naturally also includes inventories within the scope of the usual ranges. Thus the values of these assets are included in the enterprise value and are not to be considered separately. The net asset value method is therefore not usually used in valuations.

However, the situation is different in the case of non-operating assets: the value of these assets can be realised in addition to the enterprise value.

Also, when selling a company with high business property assets, the net asset value of these properties may be relevant in addition under certain circumstances. In the case of high intrinsic values in the real estate assets, it may make sense in the event of a transaction to separate these out beforehand and then sell them separately or lease them to the new company owner.

Liquidation value method in business valuation

The liquidation value is calculated from the value of the individual assets less the liquidation costs.

The liquidation value method is only used to determine the enterprise value if the values of the multiples or DCF methods are lower than the liquidation value. Specifically, this means that it appears more profitable to sell the company’s assets than to continue the business.

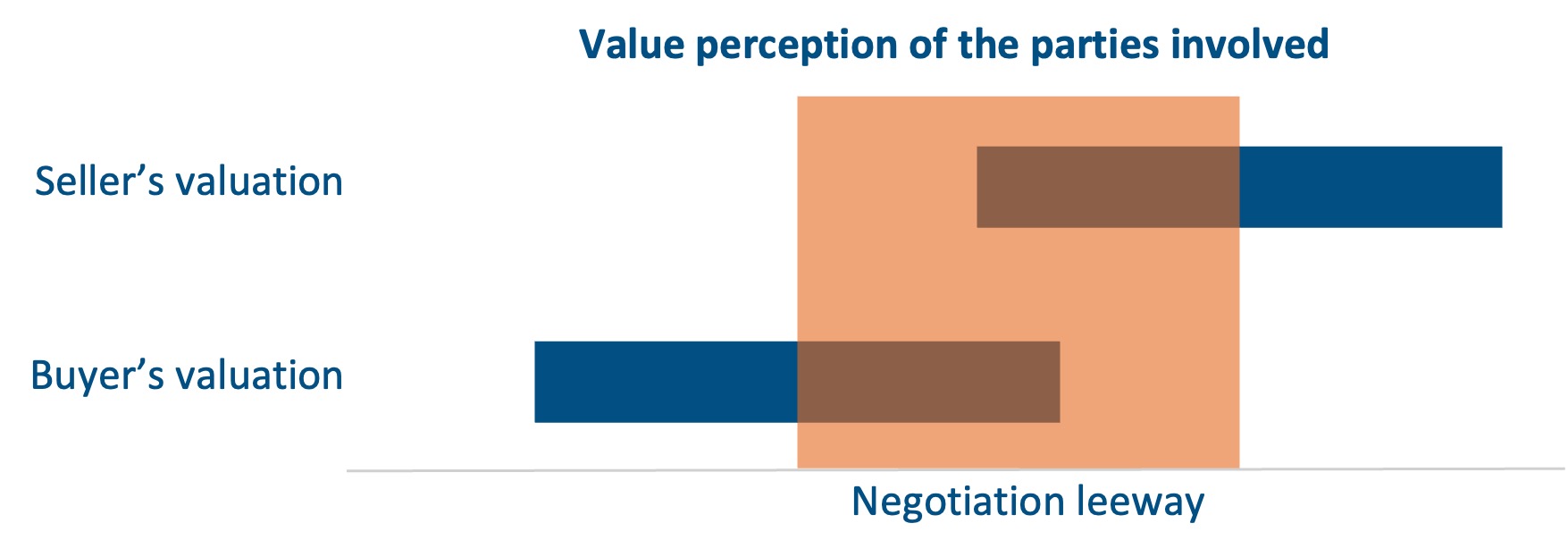

From value to price

Of course, a valuation is not yet a purchase price. The purchase or sale price of a business may be higher or lower than the pre-calculated enterprise value, as these values are each subjective and interest-bound ranges of values of the parties involved. The buyer side has certain expectations regarding strategic effects and synergies, while the seller side often sees high opportunities and only low risks. Influencing the outcome of negotiations lies in the responsibility of corporate finance advisors such as Loy & Co. In a separate article, we outline the possibilities for achieving an optimal outcome for the respective party.

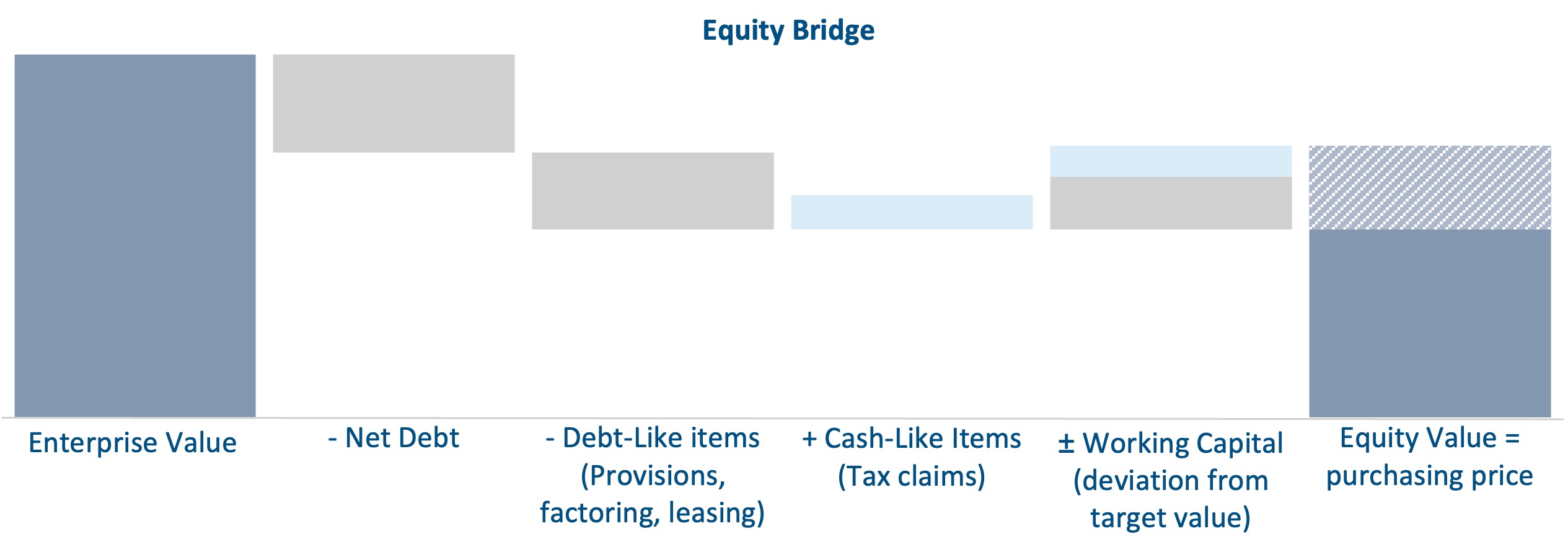

After an agreement has been reached on the valuation of the company, the next step is to derive the purchase price. This calculation from the enterprise value to the equity value is also called equity bridge. Certain items are deducted from the enterprise value to arrive at the equity value. This seemingly technical reconciliation calculation harbours more opportunities and risks for both sides than the contracting parties are usually aware of. After all, which items exactly belong and which do not, how are the relevant items to be calculated in concrete terms?

The net financial liabilities (also called net debt) consist of debts to credit institutions, which are offset by cash on hand and credit balances with credit institutions. This ratio is deducted from the enterprise value, since the buyer does not pay for the debt capital. In addition to interest-bearing debt capital, other items from provisions or other liabilities are regularly considered as deductions from the purchase price during purchase price negotiations.

In order to avoid that the seller reduces his net financial liabilities by reducing the working capital on the transaction date, a target value for the working capital is usually defined in the purchase agreement. The target value should reflect a normalised level adjusted for seasonal fluctuations. If the actual working capital on the reporting date is lower or higher than the target value, the difference is added to or deducted from the purchase price. As with the definition and valuation of net debts, there are opportunities and risks for both sides in setting the working capital target value, which must be taken into account.

Another topic that might also interest you: Asset Deal vs. Share Deal?

Your contact person

Beatrice Berg

Partner

T: +49 211 20 49 6000M: +49 176 2258 0929E: berg@loy-cf.deLoy&Co Corporate Finance GmbH

Bilker Straße 11

40213 Düsseldorf